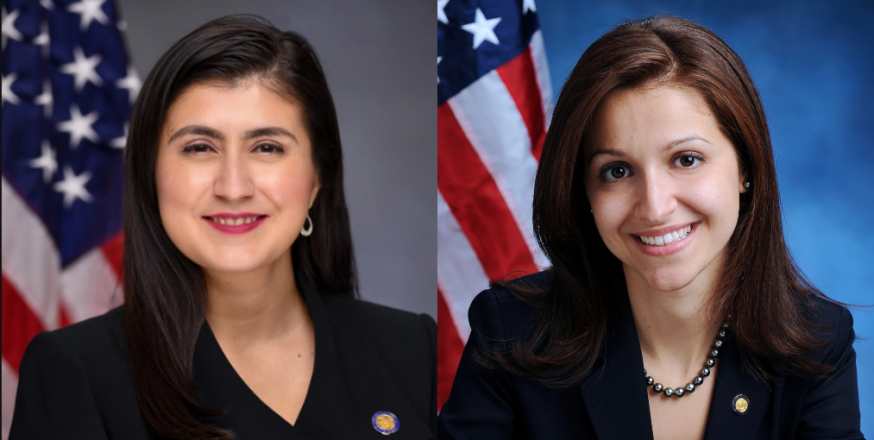

State Senator Jessica Ramos and Assembly Woman Aravella Simotas

May 7, 2020 By Christian Murray

Two Queens legislators are putting on notice publicly-traded companies that have cashed in on the federal stimulus package.

Assembly Member Aravella Simotas and State Sen. Jessica Ramos introduced a bill last month in their respective chamber that would prohibit these companies from receiving New York State tax credits should they engage in stock buybacks for three years.

Many public companies have tapped into the federal bailout programs beyond the airline industry. Hundreds of publicly traded companies have taken advantage of the Preferred Protection Program (PPP), which was part of the $2 trillion stimulus package in the CARES Act.

The program provides companies with the equivalent of 2 ½ months of payroll—up to $10 million—at a 1 percent interest rate loan. These loans are also forgiven if most of it is used on payroll.

The legislators want to make sure that these companies don’t use the cash they have on hand to buy their own stock—which essentially drives up the stock price.

The research firm Fact Squared reports that more than 350 publicly traded companies took advantage of the PPP, which was for companies with fewer than 500 employees.

Many cash-strapped small businesses have missed out on being able to tap into the PPP, crowded out by the bigger companies.

The big companies—unlike the moms and pops– have the ability of being able to issue stock or debt in the capital markets should they need funding.

“Now is not the time to allow these corporations to benefit off the backs of hard-working New Yorkers,” Simotas said in a statement. “This self-serving practice should not be funded by federal aid bailouts. The goal of these bailouts should be to help struggling companies survive.”

Simotas and Ramos said that stock buybacks have no place in these unprecedented times.

“For too long, greedy corporations have used federal emergency aid and tax breaks to protect their own wealth,” Ramos said. “We need to make sure that any financial assistance companies in New York receive to toward paying workers the paid leave and salary they are owned in the face of the COVID-19 pandemic.”

The bill has been referred to committee in both the Senate and Assembly.

6 Comments

The PPP loan is forgivable if used for payroll. If not it is a straight loan at 1 percent interest and can be repaid over a long period. These are great terms.

I thought the “no stock buy back” clause was suppose to be written into the bill. Even the president said this.

Perhaps the staffer who continues to post the 69 instant downvotes has a plan for getting NYC back on its feet?

I thought the PPP program was only allowed to be used for employee salaries?

So many companies in NYS will just close or declare bankruptcy. Many others will not have profits to tax.

Where is your plan for attracting business to NYS? The state needs building blocks to get back on its feet, not just more roadblocks.

how many will lobby/bribe their way around this? corporations own this nation.