Jackson Avenue in Long Island City (Photo: Michael Dorgan, Queens Post)

Jan. 27, 2022 By Christian Murray

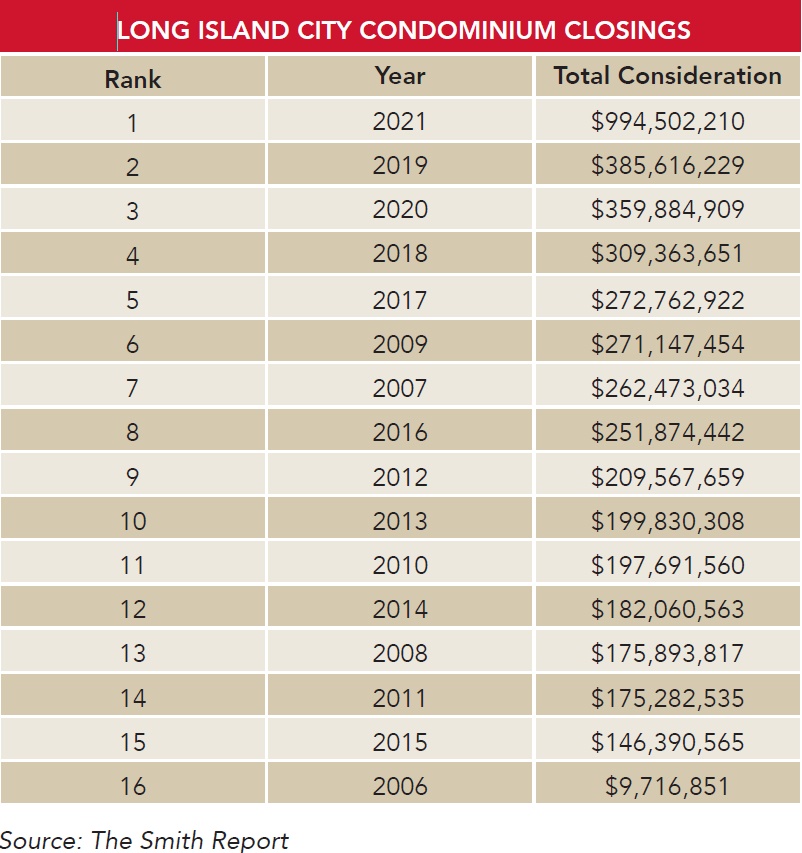

The Long Island City condo market in 2021 was its strongest on record—with sales volume reaching nearly $1 billion, about three times the previous record set in 2019, according to a new report.

There were 885 units sold in 2021, with a dollar value of $995 million. The number smashed the 2019 sales volume record of $385 million, when 336 condos were sold.

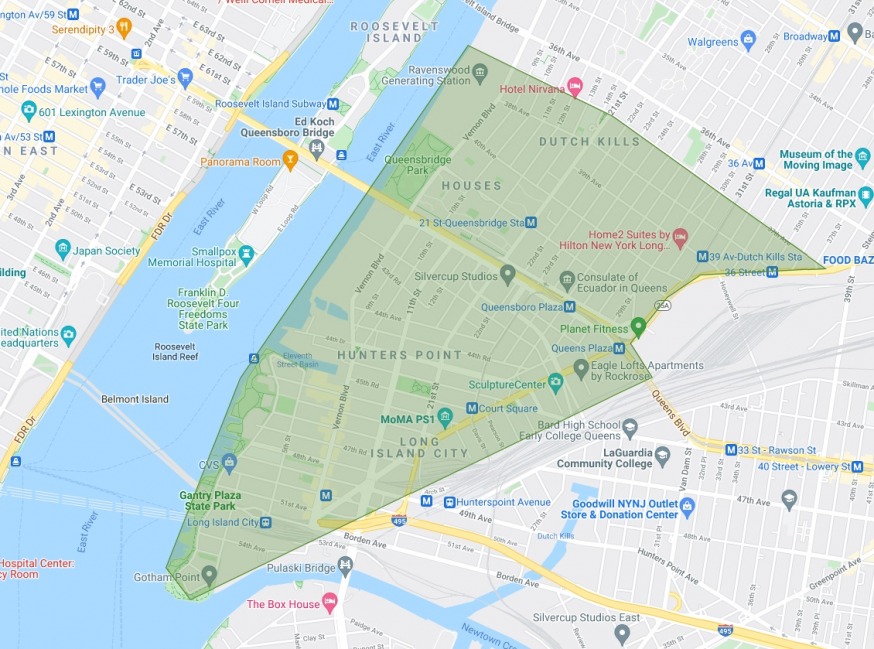

These findings are part of the 2021 Long Island City Condominium Report released by Patrick W. Smith, an independent real estate analyst and Long Island City-based agent affiliated with The Corcoran Group. The report is based on closed condo sales within the confines of 37th Avenue to the north, Borden Avenue to the south, the East River to the west and Northern Boulevard to the east.

The report is based on closed condo sales within the confines of 37th Avenue to the north, Borden Avenue to the south, the East River to the west and Northern Boulevard to the east. The area is represented in the shaded area

“The Long Island City market did extremely well in 2021 because sellers priced their units competitively and the demand for Long Island City continues to grow,” said Patrick W. Smith, the author of the report. “Long Island City also remains at a significant discount to Manhattan.”

Smith said that the market also benefited from low interest rates and a stock market that has surged over the past two years. He also said that the job market was particularly strong for many of the buyers who work in the tech, finance and legal industries.

He said that Long Island City’s popularity continues to increase as new stores and businesses come to the area—such as Trader Joe’s on Jackson Avenue—and its waterfront parks gain greater recognition.

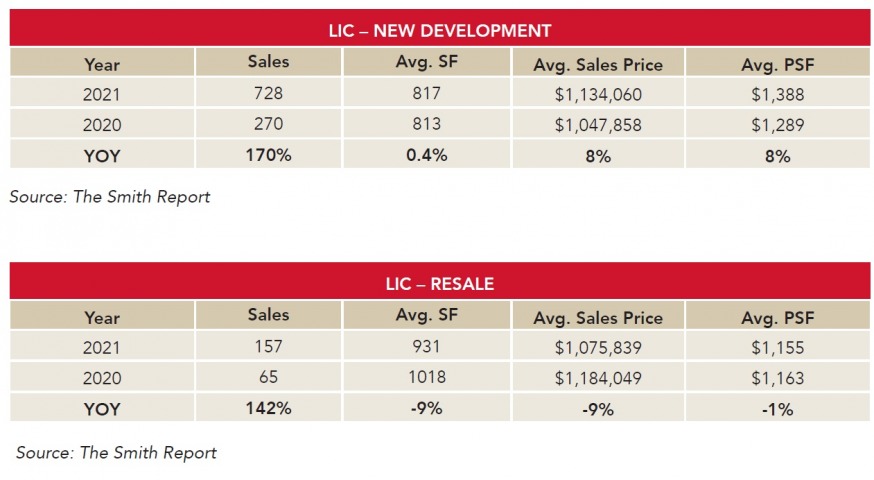

The sales volume in both the new development and resale market was extremely strong in 2021, according to the report. There were 728 condos sold in the new development market, up from 270 in 2020. Meanwhile, 157 condos sold in the resale market—a record—significantly higher than the 65 sold in 2020, 85 in 2019 and 95 in 2018.

Prices across the Long Island City market were up. For instance, the average price paid for a condo in 2021 was $1,124,000, up from $1,074,000 in 2020. The average price for a one-bedroom last year was $912,000, up from $900,000 in 2020. Meanwhile, the average sales price for a two-bedroom condo was $1,382,000, up from $1,328,000.

The new development market across Long Island City outperformed, with the average sales price on the 728 units sold coming in at $1,134,000 in 2021, up from $1,048,000 in 2020 when 270 units changed hands.

The average increase can be attributed, in part, to the Skyline Tower development, a 67-story luxury condo building with 802 units at 3 Court Square. Closings in the building began in 2021—and 332 sales were recorded, accounting for $415 million in sales volume. The average price paid for a condo in the Skyline Tower—based on closed data– was $1,251,000 million, pushing up the numbers for the overall market.

Excluding the Skyline Tower, the average price paid for a new development condo in 2021 was $1,036,000. This figure was slightly less that the average price paid for a new development condo in 2020.

Smith said that 33 percent of the buyers in the Skyline Tower were cash buyers, compared to 17 percent for the rest of the Long Island City market. He said that 70 additional units are under contract—based on StreetEasy data—and that other units may be under contract that have not yet been reported.

A rendering of the Skyline Tower (left) next to One Court Square (Binyan Studios)

“The overall number of sales and dollar value is very impressive,” Smith said in reference to the Skyline Tower. He said that the dollar volume in the Skyline Tower alone was greater than the entire market in previous years.

Smith said that the slight price decline in the new development market (excluding the Skyline Tower) can be attributed, in part, to the increase in the number of new condo developments in the Dutch Kills section of Long Island City—generally a more affordable area. He said there were 112 closings in 2021 in the area north of the Queensboro Bridge, compared to just five closings in 2020.

This section of Long Island City continues to grow. For instance, The Durst Organization’s 71-story, 928-unit rental development at 29-37 41st Ave, is now in the process of being occupied.

The overall resale market in Long Island City was also robust in 2021—although prices softened. The average price paid in 2021 was $1,076,000, compared to $1,184,000 in 2020.

The average price paid for a one-bedroom condo in the resale market was $873,000 in 2021, compared to $1,004,000 in 2020. The average for a two-bedroom resale condo was $1,309,000 in 2021, compared to $1,317,000 in 2020

Smith said that many people who sold condos in 2021 had bought them years ago at a much lower price and priced them to sell. He said demand for the units were high, although buyers had a large inventory to choose from in 2021.

Smith said the Long Island City market continues to remain strong both in terms of price and sales volume. He said that rising interest rates and a volatile stock market has not slowed down activity.

“We are still seeing strong demand in January– a similar level of demand to 2021.”

For additional information, click on thesmithteam.nyc