(iStock)

July 12, 2022 By Michael Dorgan

The average price paid to nab a studio in Queens in June was over $2,000 per month, with the average for a one bedroom hitting $2,500 for the first time on record, according to a new report by the real estate firm M.N.S.

The average price paid for a studio was $2,045, up 12 percent from June 2021, according to the report. The average for a one bedroom was $2,500, up 16 percent from a year earlier, and the average cost of a two bedroom was $3,322, representing a 23 percent jump year-over-year.

Rental prices increased across the borough, although they skyrocketed in Astoria, Long Island City, Forest Hills and Jamaica, the report revealed. The report did not provide a breakdown for Sunnyside or Woodside.

The average price paid to snag an apartment in Astoria last month was up 32 percent compared to June 2021. In Long Island City, the average rent was up 28 percent from 12 months prior, while in Jamaica and Forest Hills it was up 21 percent and 16 percent respectively.

Source: M.N.S. Real Estate

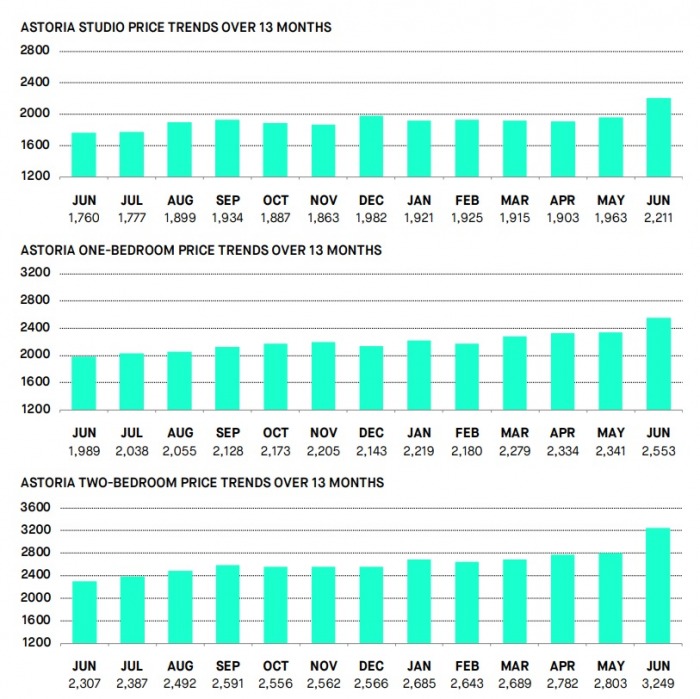

In Astoria apartments of all sizes saw lofty increases — although it was most notable with the bigger units.

The average rent for a studio apartment in Astoria in June was $2,211. This figure was up 26 percent — from $1,760 — one year prior.

One-bedroom apartments in the neighborhood saw a 28 increase — with the June average being $2,553, up from $1,989 in June 2021.

The average rent to get into a two-bedroom apartment in Astoria was $3,249, up a whopping 41 percent from 12 months prior. The average two-bedroom went for $2,307 in June 2021.

The red-hot Long Island City rental market shows no signs of cooling down.

The average price paid for a studio apartment in Long Island City in June 2022 was $3,144, up 24 percent from a year ago; a one-bedroom fetched $3,970, up 31 percent from 12 months earlier; while a two-bedroom went for $5,463, up 28 percent.

To view the full, click here.

Source: M.N.S. Real Estate

Source: M.N.S. Real Estate

13 Comments

while i agree that owning is the way to go…if you think the rents are high have you researched what homes in queens cost..have a friend in LIC who told me a parking spot was sold for over 100K…and while i can sympathize with landlords who gets screwed by many a tenant in the end anyone who has lived in queens for over 20 years can tell you its GREED that have caused the high rents and all the trickle down problems it brings

Dear AOC, please fight for us, not to lower rent, but for rent reform, so the city and state can pay for all our rents and utilities for up to a year. Republicans believe in hard work, and I’d like the easy way out. Screw the landlord. Antifa and BLM all the way.

And you won’t need a glorified bartender to rescue you. You can’t afford where you’re living, get a job or find somewhere else to live. No nycha buildings should have parking lots.

20yrs ago I purchased one family house . I did ot want the headaches of having tenants & etc .My monthly pymt is $1250ish not including taxes ,ins & utilities

I got a nice backyard& have BBQ & yes its a lot of work but who the hell wants to pay over $2000.00 for apartment & deal w noisy tenants,smell, roaches & etc.

Well good luck to renters .

Still cheaper than many places in Manhattan and Brooklyn. And of course it will cost you more to live with a certain demographic. The pandemic is over so pay your rent or get evicted. I have bills to pay as a landlord of two homes.

That is because rent vouchers that the city provides increased to $1900 for a 1 bedroom last year. Thus landlords increased rent to avoid having to put those who qualify for rental assistance in.

Those vouchers have been inflating rents, property values and creating inflation for a long time. Without them landlords would be forced to lower rents or be faced with vacancies also property taxes would not be as inflated. vouchers are federal so is the salt deduction such a racket. All hurts the hard working middle class who pay there own way and they always work to keep it as just barely pays their own way.

Home ownership is still the best bet against renting.

The ones on the market or a dump. Just old homes that need to be gutted down. All over a million. Hopefully inflation and higher loan rates will push prices down. There is also a big chance of a recession and continuation of pandemic with covid and monkey pox all over the USA. Hopefully renters will start packing again in September and fly back home to work remotely to bring down the rents.

Putin’s fault!

All these numbers are such bs. All these new luxury high rise developments are distorting reality.

you’ll always have those they spend both paychecks a month paying high rent for fake “luxury” apartments, and those that sacrifice that so called luxury and live father, and spend below their means, and save up, and buy a home.

C’mon- What if someone doesn’t want to buy a home?